Surviving in Greece using an alternate currency

We do, but it's full of ideological thinking from the current minister and usually false by a large factor. If they say they'll spend €500 million, they'll spend approximately €800-900 million. If they say the situation is good, the situation is bad. If they say the situation is bad, the situation is dangerous. If they say the situation is dangerous, flee the country. They're currently saying the situation is bad, and they're desperate for money to pay for more inevitable European expenses. They've tried to cut money everywhere - from education to healthcare to trying to sell all of our tanks to regimes that don't like human rights. They've cut budgets from orchestras, they've ceased subsidies to museums, they've abolished a lot of public transport routes in the cities, they're suddenly lowering pensions for people who've spent forty years building them, and still they're ending up with an exploding debt and a negative outlook.

Our nominal GDP before another recession was about €840 billion. Assuming the economy magically picks up instead of declining even further as even the most optimistic predictions say, and the economy gets back to that level, the expenses for the new European Stability Mechanism alone are about 5.9-6% of our annual GDP. That is in the best case. Saying it doesn't approach 2% is hardly fair. That's one expense, excluding bilateral payments, regular net contributions, participation in programmes and aid through temporary mechanisms. We're being bled dry to float a sinking ship for a bit longer, and Moody's has picked up on that, changing the outlook for Luxembourg, Germany and the Netherlands to 'negative'.

Oodain

Veteran

Joined: 30 Jan 2011

Age: 34

Gender: Male

Posts: 5,022

Location: in my own little tamarillo jungle,

i took those numbers directly form the link you presented earlier.

again i dont care what you say the percentages are, find me a link so i can make my own opinion about it.

also if there is a financial charter is should have direct amounts netered into it, the ideology of such a charter is irrelevant.

_________________

//through chaos comes complexity//

the scent of the tamarillo is pungent and powerfull,

woe be to the nose who nears it.

Here we go. I'll deliver.

http://www.cbs.nl/nl-NL/menu/themas/mac ... 1-ne-e.htm

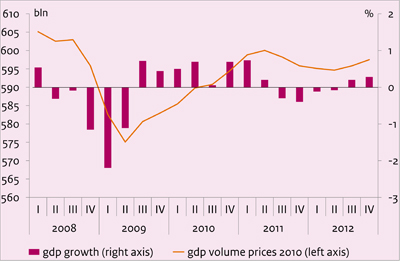

It seems the situation is still rather chaotic. A small addendum before you conclude anything about current trends from that graph, dated 2011. The expectations for 2012 have shown to be overestimated again. The first quarter actually showed a growth of -0.8% instead of the -0.2 predicted there. Instead of a trend up, it's been a trend down for the first quarter of this year. That's what you should always keep in mind. Even though this public institution corrects figures provided by almost halving any expected profits, it's always too optimistic in recent years.

http://www.european-council.europa.eu/m ... 2.en12.pdf

Here is the full text of the treaty establishing the European Stability Mechanism. In the last pages, it shows the starting amounts of money, presumed less than the total amount needed in the end, which amount to €40,019,000,000 for the Dutch government, or more than €2300 per capita. Not included in that are our contributions to other, temporary funds that were used for Greece's first few rounds, our semi-forced private investments, our payments for Spain and Portugal, our contributions for Ireland, and any other expenses. In case you were wondering, Germany is paying €190,024,800,000 and Luxembourg is paying €1,752,800,000. Mind you, this is money none of these countries actually have, and they're all heavily in debt themselves, with occasional worrying deficits.

Denmark and the United Kingdom can count themselves lucky for not having fallen for this dead man's project.

The government, meanwhile, does not publish these figures itself. Usually, that task is handed to the Centraal Planbureau, who made the graph pictured above.

And by comparison whole cities are declaring bankruptcy in the US and the dollar is still a safe haven.

California is in a worse budgetary position than Greece and it's economy is much larger but nobody cares.

Europe needs to go the whole fiscal union hog, be a United States of Europe, shoot Merkel in the back of the head and print the arse out of the Euro. These debts need to be diluted and devalued, Europe needs a decent amount of inflation to fix the euro problems and figure out a proper balance of payments system internally.

Even if it's giving 2 million Germans a voucher for a free holiday in Greece every year, anything to fix the internal flows will work.